Yield, DeFi and BTC Hoarders: How NEAR Fits in this Entropy

This article is fueled by excessive amounts of happy chemicals released in the brain, which is a normal human reaction that occurs after surviving 3 years of a severe bear market and seeing BTC breach an ATH. Be warned.

We’re in the middle of the financial revolution and you are the one holding the banner. No, really. If you are participating in the current state of the ecosystem, you are officially one of the early adopters that put their energy and money into this absurd and bizarre quasi-financial industry which is shaping out to be something that might save the traditional financial system. Don’t believe me? Fine, but even NASDAQ is writing about it.

Currently, the yields in the traditional economy are disappointing. 10-year Germany sovereign bonds are at -0.567%, and this is not , as there are more European countries that have a negative yield. So you are paying money to hold their bond. This is partly driven by the Covid depression, but quantitative easing (money printing, which is a common meme nowadays) is also at fault. However, if you invest enough money in ETH and set up a node, you can get 5%-20% APY (the number at the time of writing this article is still subject to change). NEAR makes you around 14% annually. Way better than paying money for holding sovereign bonds, right?

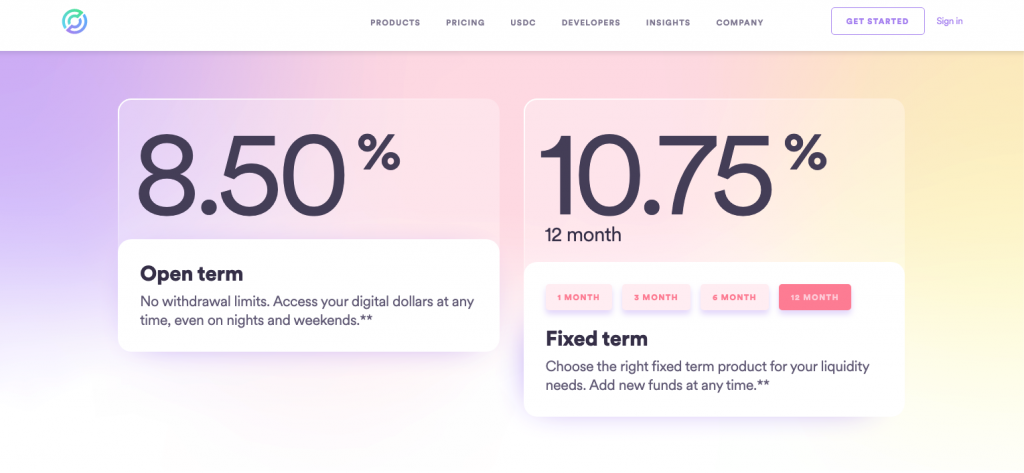

Of course, this is not an intellectually honest comparison because risks involved in holding sovereign bonds and staking some weird blockchain tokens are different, and therefore you are being paid a premium for taking on these risks. Fair enough. However, the space matures, good projects emerge out of the entropy and tech gets refined. And as tech gets refined and the risks diminish, new opportunities appear. For example, Circle is offering a waitlist for their new feature – a dollar deposit account that offers you 10.75% fixed term annually. And this happens in an economic environment where you essentially have to pay for holding some sovereign bonds. Circle can do this through different DeFi strategies that probably yield them around 15% annually, of which they give 10.75% to the depositors and leave rest as profits and as treasury in case of a crisis.

Even though this is still proof of concept and not a full-fledged feature, it allows us to take a look at the possibilities that the future might offer usAnd the most exciting thing is not even the fact that in a few years you might be able to add a few zeroes to your total portfolio – it’s that now there is an alternative to the financial system. Now you have another way of getting yield rather than banks or traditional investment – obviously, if you are bold enough and are comfortable with tech.

The paradigm is changing rapidly – more and more funds are purchasing Bitcoin and coming out about their investment (fill before shill, remember). The last addition at the moment of writing this article was One River Asset Management that claimed that they invested 600 million dollars in Bitcoin in November. And that they are planning up their stake to 1 billion dollars of Bitcoin and Ether in 2021. So what does this tell us? Institutional investors acknowledge the opportunity that Bitcoin constitutes, especially under these global economic conditions. However, they also acknowledge Ethereum, which doesn’t really fit into the digital gold narrative – but does fit into the “enabling the alternative financial system” narrative. Ethereum supply is not limited, whereas Bitcoin is limited at 21 million coins. Ethereum is not hard asset in a sense that Bitcoin is. But it has a very important quality – almost everything is being built on Ethereum, whereas Bitcoin is just an investment vehicle.

“Why did you mention entropy in the headline?” you might ask me. Because this whole thing is still a chaotic Wild West. The progress of the space will be evident in hindsight 20 years later and it would seem like blockchain, digital currencies and DeFi just came into our lives and stayed there. But only the OGs would remember the chaotic, entropic nature of the progress – rugpulls, times when it seemed like blockchain is just a gimmick, exchange hacks. And all these events shaped out something new and beautiful – with some people losing it all in the process. All hail to sacrificial lambs of the new financial frontiers.

There is a concept called the Lindy effect, which roughly means that popular things age “in reverse”. So if the book was in print for 5 years, it will most likely last around 3 more. But if it was in print for 15 years, chances are that it will be in print for 14 more years. And if the book is in print for a century, it will probably live two more at least. This is logical, because if the idea survives, it survives. You can still find a two thousand year old book in your hotel’s bed stand table.

The Lindy effect relates to our topic because Bitcoin and Ethereum are very Lindy – a piece of technology that survived long enough for us to claim that it will survive for an even longer time. One might contrast that to the ghost chains that were “Ethereum killers”. Therefore we can pretty safely assume that Ethereum is going to stay here for a while (going to be excluding Bitcoin from the conversation, because it safely went into the “store of value” category, probably for the better).

Ethereum is the lifeblood of the current crypto ecosystem as it powers the loans, the on-chain option protocols, and the Uniswap gambling. However, the main problem with Ethereum is that higher transaction speed and lower fees are urgently needed, and they aren’t going to arrive anytime soon, as ETH 2.0 has only started. At the peak of the DeFi craze, it wasn’t uncommon to spend $50+ on gas for a single Uniswap transaction. Obviously, the future of finance can not be built with that kind of fee structure.

Here is where NEAR comes into play. Like other “Ethereum killer” platforms, NEAR has an advantage of being a new network – meaning that they don’t have to design a Proof of Stake system on top of the existing one, which is the case for Ethereum – they can just build a great one from scratch. However, unlike other “Ethereum killer” platforms, the NEAR team realises that Ethereum is not going anywhere, and that projects building on top of it are unlikely to move to other platforms completely. It is almost like a DeFi Lindy effect. “If a project accrues 10 million in total value locked, it will most likely be a rugpull. But if it accrues 100 million, it will likely reach 1 billion”. And if projects won’t move completely, we can pull the same trick that DeFi devs pulled on Bitcoin – “wrap” and lock Bitcoin and put the tokenized coins on Ethereum, so-called wBTC, wrapped Bitcoin. Same thing here – NEAR “listens” to what happens on the Ethereum network (and vice versa) and wraps Ethereum assets, if needed. So all of the transaction-heavy operations can happen on NEAR, but the assets can stay on Ethereum. Win-win.

The future of DeFi is bright, and so is the future for NEAR. The project couldn’t launch its mainnet at a more perfect time – the market is booming, more and more projects are launching, venture capital is flowing, and even the institutions are going in. But what is more important – is that the NEAR’s team understands what it takes to thrive in the chaos of a nascent tech industry. And in their case, it means collaborating with Ethereum so the two networks propel each other forward rather than cannibalizing each other. And honestly, NEAR also might be a very profitable opportunity for you, regardless of your role – content creator, investor, dev. You just have to survive the entropy.