Crypto is an emerging industry – we all know that. Some of us have done this before, in the 1990s during the early days of the internet. Others are here for the first time. With market volatility and crypto twitter, it’s pretty easy to lose sight of the bigger picture and revert back to common paradigms of viewing product development, competition, and new products. But emerging industries are usually different – at least at first – and even then, crypto is very different from other industries.

This article provides an informal overview of how I think it would be healthy to view NEAR’s development in parallel to Ethereum. To date, there have been lots of narratives surrounding Ethereum: Ethereum Killers, Ethereum and Open Finance, Ethereum outgrowing Bitcoin, as well as interoperability between Ethereum and other L1’s (like NEAR or Polkadot). Everyone is very opinionated on the topic, and understandably so: If you have stuck around with Ethereum over the years, you are undoubtedly fond of it. Or, if you missed the boat, you might be looking for the next opportunity.

Regardless of what your background is, there is a certain picture I want to paint that hopefully does justice to the context of NEAR’s development alongside Ethereum. While that picture will touch upon technical details and protocol design features, as well as the words of NEAR Co-founder Illia Polosukhin, it actually starts with a comparison made by Haseeb Qureshi, Managing Partner of Dragonfly Capital:

“NEAR is not trying to kill Ethereum. At this point, Ethereum is going to forever be a fixture in the smart contract landscape. Rather, NEAR collaborates with and augments Ethereum, as another major city in the landscape of blockchain networks.”

Smart contract land, is the name of the space Haseeb refers to when referencing the development of different cities, farms and suburbs (i.e. different protocols, Layer Twos, etc). And when we look at project development from this perspective, it actually dissolves a lot of the artificial divisions we might make between the ‘competition’ and ‘success’ of projects compared to one another:

Cities rise and fall. Some cities endure for thousands of years, while other cities fade out over time as resources are depleted or better infrastructure is built elsewhere. It’s a process, and at the very center of the process is the identity of the city in question: What kind of a culture does the city have? Is it expensive? What kind of people does it attract? Does it have a massive population? Or perhaps a key focus on sustainability or innovation?

Another point to keep in mind, is that while some people really identify with ‘their city’ (like New Yorkers or Bostonians) others who grow up in the suburbs, may come to spend time between cities. The point is that comparing cities is not necessarily a metrics-based-comparison, as much as it is a value, culture, infrastructure and identity-based comparison. How should that affect how we view NEAR and Ethereum?

There Are Some Fundamental Design Differences Between NEAR and Ethereum

Anyone who takes the Open Web and the development of Crypto seriously needs to be able to ask themselves the following three questions:

1. Scalability: For where crypto is going in the future, is Ethereum (or my favorite L1) capable of scaling over time to handle massive levels of mainstream interest and adoption?

2. Developer Friendly: For how cryptocurrencies and smart contracts will evolve into traditional computer science and software development, is Ethereum (or my favorite L1) developer friendly, accessible or appealing?

3. Usability: For the global user-base that we expect to use all of these dApps, is Ethereum (or my favorite L1) cost effective, easily accessible and intuitive for new users?

NEAR

NEAR is building a city of the future, based on the original vision created by Ethereum. NEAR’s city is going to be massive, but it will take time for it to grow. NEAR’s City will be a central hub for future crypto innovation and emerging technology integrations, and will attract developers and entrepreneurs interested in quickly getting their business launched. It will be a commercial hub, where anyone and everyone – from any background can participate in the Open Web and a new ownership economy, regardless of where they come from or what they believe in. And perhaps most importantly, it will be a city with a culture of inclusion: Where companies port across ecosystems to other blockchains – like Ethereum – and where the people are friendly.

Ethereum

Ethereum is the city of the future manifested in the present. It’s extremely developed, beautiful, funded and renowned. A definite wonder of the crypto-world – today and for the next two hundred years. As the first city of its kind, Ethereum attracts the best and the brightest getting into crypto. However, it’s not the most inclusive place: A large portion of its population has lived in Ethereum since before it was this glistening behemoth of the new world. The language can be hard to learn. And parts of the city can be extremely expensive. The character, nevertheless, is that of a global hub for Decentralized Finance and Enterprise Blockchain. The value of the city towers above anyone who goes into it.

A Tale Of Two Cities: Scalability

Let’s address the first question:

For where crypto is going in the future, is Ethereum (or my favorite L1) capable of scaling over time with massive levels of mainstream interest and adoption?

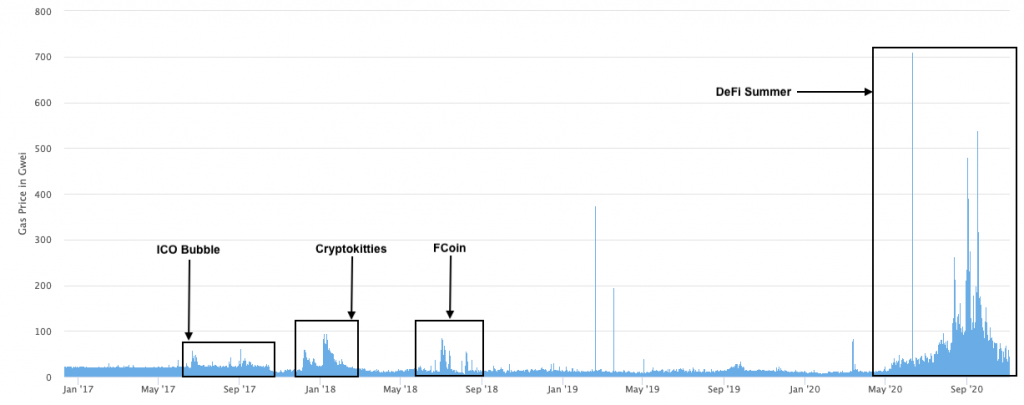

We all know that Ethereum Gas problems have made scalability a challenge.

DragonFly Capital: https://medium.com/dragonfly-research/dragonfly-near-b24537af6f8d

And while the Ethereum team is hard at work, Haseeb refers to the amount of time it will take for a durable solution to be implemented as a long-term solution:

“Vitalik recently claimed that smart contracts on Ethereum 2.0 will take so long, Ethereum has to go all-in on rollups in the intervening years.”

This is where things become interesting if we ask the same question in relation to NEAR:

NEAR is already launched as a horizontally sharded blockchain platform. As Illia explains, block times are quick, and fees miniscule:

“Right now we have 1 second blocks, roughly, and 2 to 3 second finality, right. Which in comparison to the ETH 2 approach you guys have like 12 second slots and 13 minute finality or something like that in the best cases. So that is a spectrum, and finding how to create tiers of security – that is what we did with our shards. There will be a lot more validators on the shards then block production.” (Illia – Grilling the Rainbow)

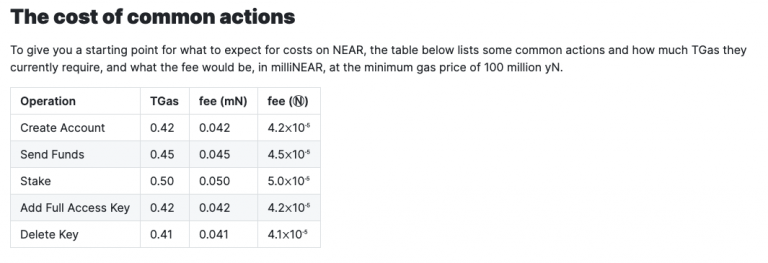

In terms of costs, that translates to an initial price for 1 TGas being 0.0001 N. Making one block 0.1N at the minimum. A larger overview for setup costs on NEAR is listed below:

Overall, NEAR has baked scalability into the core design of the protocol so that as more projects start to build on top of the network and more transactions accrue, the network is able to naturally handle the transaction load by adding more shards:

“To give you a sense for the sheer scalability improvements NEAR offers, each shard on the NEAR blockchain can process 10x more transactions individually than Ethereum 1.0. The NEAR blockchain will eventually have over 100 shards. This means that NEAR will eventually be able to process over 1000 times more transactions per second than Ethereum 1.0.”

One conclusion to take away from this is that while Ethereum will most definitely find a way to continue to operate, it will be some time before it is able to scale at a cost and speed comparable to NEAR. NEAR, while handling significantly less value than Ethereum (eons less in fact) is designed to handle transactions in a quick and cheap manner.

A Tale of Two Cities: Developer Incentives

A 2020 Global Developer study suggests that there are 26.9 million developers around the world. By 2030 that number will increase to 45 million. As the study goes on to explain:

”We can expect an approximate 75% growth in the number of software developers worldwide in the upcoming decade” (Future Processing Business Blog)

From within this context, any person who is seriously invested in the future of crypto and the widespread development of crypto-based solutions and products, needs to then ask themselves the second question from above:

For how cryptocurrencies and smart contracts will evolve into traditional computer science and software development curriculums, is Ethereum (or my favorite L1) developer friendly, accessible or appealing?

Let’s take NEAR first this time:

NEAR is built by and for developers who want to quickly and easily create blockchain-based dApps, games, and other Web3 solutions. To do that, developers can code in Rust and AssemblyScript. Even more interesting, is the small benefit directed towards developers once they have deployed their solution: Developers take 30% of transaction fees home with them from their contracts. These are things that have been said before – what matters is the effects of this design.

NEAR is built to appeal to the developers of the future by allowing them to build solutions in more familiar programming languages. A lot of other L1 protocols have taken a similar approach (so in this sense it’s not a super unique characteristic of NEAR). The fact that developers take home 30% of rewards from their contracts, is a statement of how value is viewed on the protocol: Developers are natively rewarded by the protocol for building on top of it.

Ethereum was never created with the thought of appealing to the 20 million new developers that will sign onto the internet between 2020 and 2030. It was the first of its kind. And in this context, Solidity is a programming language that may someday look a lot like Ancient Greek: It inaugurated a paradigm shift in computing, but it remains difficult to learn and expensive to contract for.

That being said, building on Ethereum does have a number of advantages for developers: Massive amounts of Layer 2 infrastructure (i.e. Matic) has been built to accommodate developers. A huge world of development opportunities exist on top of existing L2s that can be done in other programming languages, and a huge network exists to source talent, connect to existing solutions, and scale an existing product.

A Tale of Two Cities: Usability and Accessibility

Crypto Twitter is good at creating the illusion that the world of crypto exists in a parallel universe to the rest of the world. But as the history of innovation and technology diffusion has demonstrated at length, dating back to the first industrial revolution, any general purpose technology that creates value is inevitably positioned to tip into other industries with massive network effects. Crypto is no different.

That means that the Layer 1 Protocols of today, like Ethereum and NEAR, need to be asking themselves what was listed above as the third and final question:

For the global user-base that we expect to use all of these dApps, is Ethereum (or my favorite L1) cost effective, easily accessible and intuitive for users?

Let’s start with Ethereum on this one: User-engagement presupposes a certain familiarity with Crypto, that does not look to change in the future. Setting up a MetaMask wallet, figuring out private keys and wallet addresses, and navigating custom network RPC’s is baked into the design of Ethereum. That is not necessarily a problem right now, but it is unclear how that will change in the future as more users coming from a more familiar digital environment begin to experiment with crypto.

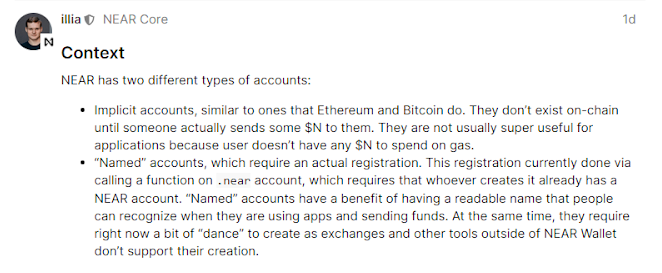

NEAR, differentiates itself from the pack when it comes to usability. On NEAR there are two different types of Accounts:

Source: https://gov.near.org/t/account-faucet/458

As Illia explains, accounts on NEAR are able to be ‘named’ with an AccountID. These accounts in turn have additional progressive security features including email and phone number verification and backups.

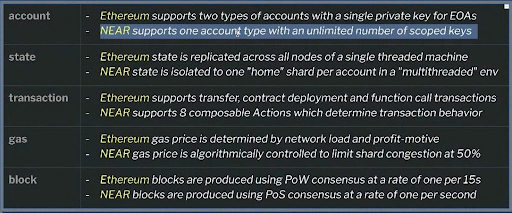

The Main Differences Between the NEAR Account Model vs. ETH

Notably, this model can create its own host of problems as well (i.e. See here the Account Faucet Discussion), but the overall intention is to make the NEAR ecosystem more user-friendly, intuitive, and familiar to new users. Future projections about mass adoption and new users entering the space are exactly that – projections – so the real effects of the different user-engagement designs will only be revealed in time.

What Does A Tale of Two Cities Entail Into the Future?

To conclude, I want to take a big-picture view of the crypto space and its development in the coming decade. One thing that I think is highly underestimated in this space, is the lack of focus on accessibility for new participants:

If we believe that Web3 will continue to grow in both development and users in the coming decade, we need to ask where those users will be coming from?

While one may stereotypically assume that Europe, the United States and East Asia will be the fundamental drivers of the crypto revolution, others hold that much of the developing world will be the primary users of a lot of the core products being built today. Charles Hoskinson, Founder of Cardano and current CEO of Input Output, discusses in the interview below why he believes that the future of crypto is largely to be found in developing economies predominantly in Africa, South East Asia, India, and South America:

In the context of building the great blockchain cities of tomorrow, it is important to recognize that in order for crypto to be accessible and appealing to this massive user-base, it also has to be affordable. And while protocol gas fees are high on ETH, much like an expensive city, the crypto space is young and looking to expand outwards.

Into the future, the two cities of NEAR and Ethereum will both continue to build and morph into deeper and more complex environments. Time will tell what unique characteristics, identities, and cultures they both come to reflect.