On 11 November, 2020 Flux CEO Peter Mitchell hosted a low-profile AMA in the Flux Protocol official Telegram group. As one of the most overlooked AMAs to date a number of extremely important updates on the development of Flux were dropped by Peter: don’t sleep on this one – it is as hype as it gets! A brief overview of the most important points discussed is outlined below, while a full transcript of the AMA is included at the bottom.

Trending Prediction Markets

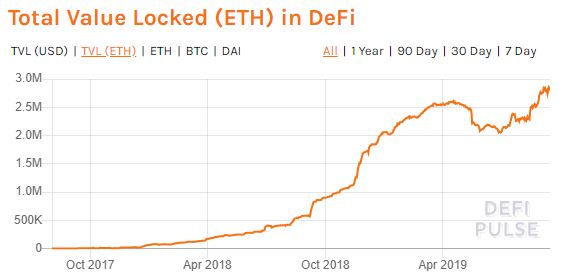

The AMA kicked off with Peter talking about the recent traction seen around prediction markets especially during the presidential election in the United States. He mentioned that it’s been awesome to see prediction markets take the main stage in the election. Moreover, Peter is excited for the future of markets around politics, and the strong position of Flux in this industry.

“After building in the space for a couple years it was really awesome to see prediction markets take the main stage in be featured so prominently in the US election. I think this is only the beginning and there were a lot of hindrances holding back serious usage, but I think Flux will be primed for upcoming markets around politics.”

Real Money

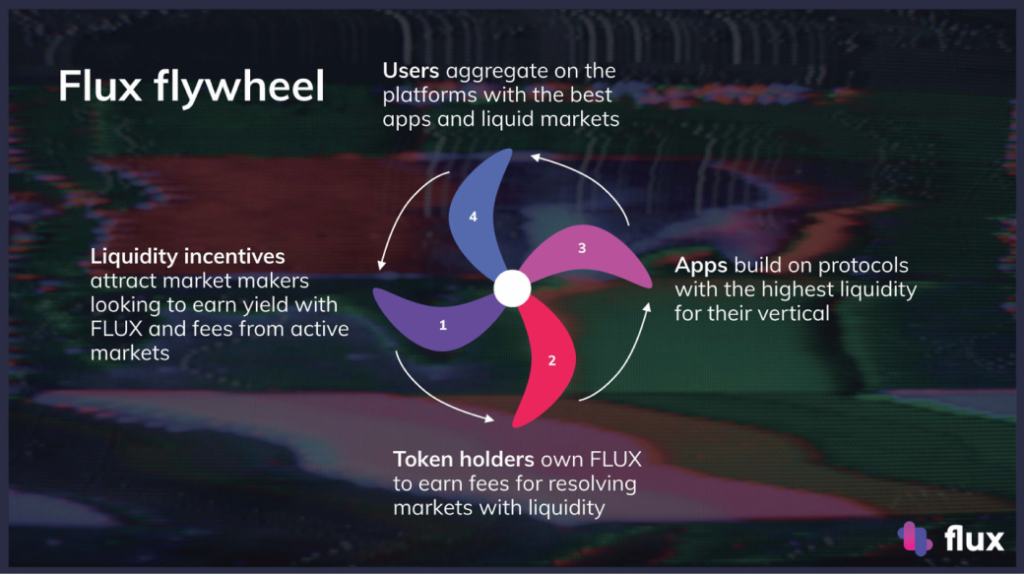

While categorical and binary mechanics are already live on Flux mainnet today, scalar markets (prediction markets with numerical denominators) are soon to be implemented as well. With scalar markets, one is able to start a prediction market, for example, on how much airline stocks would go up by the end of Q4 2020. With this new feature, new types of prediction markets can be set up. “Testing with actual money starts on Friday 13 November 2020” Peter casually dropped. “At the beginning it will be capped usage to ensure we can refund any funds that could be at risk”, he added.

Quantstamp Security Review

A few issues with varying levels of severity were found during the security review. These issues have been resolved in the meantime. Furthermore, the engineers at Flux are finishing up rewriting the code base. They’re doing this to include better documentation so the protocol is easier to build on, and effectively reduces the time needed for future iterations and audits. Upon completion of these fixes, Flux will be primed for public launch, and ready to scale across prediction markets!

Pressure from competition

Notably, Peter was asked if he feels any pressure from competitors in a way that makes him feel the need to move faster. To this he replied:

“At the moment the market is so young that I think all competitors have the same goal which is to bring in mainstream users. This is a net positive over all for crypto. I think competition will heat up more in roughly 6 months as usability increases and more users begin to enter into crypto. This will then center around a permissionless nature, cheap transactions and the most sticky UX.”

With their current team and roadmap in place, Flux Protocol is by any measure, well on its way to position itself nicely within this industry.

Behind the Scenes

To any Flux community member, it was apparent that the Flux team limited their engagement with the community over the course of the last couple of months. The reasoning behind this is that there were many fake Flux Tokens listed on DEX’s with legal concerns capable of interfering in project development.

Full Transcript of the AMA

- When moon?

- No comment lol

- What are your thoughts on the traction seen around prediction markets during the election?

- After building in the space for a couple years it was really awesome to see prediciton markets take the main stage in be featured so prominently in the US election. I think this is only the beginning and there were a lot of hinderences holding back serious usage, but I think Flux will be primed for upcoming markets around politics

- Release date for scalar markets?

- Categorical and binary mechanics are live on mainnet today and testing with real money starts on Friday. The scalar mechanics are very simple to implement so likely over the next few weeks to get that live.

- Is Flux hiring developers to work on the protocol?

- Yes we are actively hiring engineers!

Check out our website here fluxprotocol.org

👉 Join the Official Flux Telegram and be sure to follow 4NTS Guild and Flux Protocol on Twitter so you don’t miss out on the next community event!