NEAR Without The Noise Episode 8 featured the CEO of Sino Global Capital, Matthew Graham. The discussion served as a perfect introduction to understanding the Crypto Industry in China from someone working on the front lines of crypto and financial investing for the past eight years. Over the course of the hour, 4NTS Guild Members joined by NEAR’s Head of Ecosystem Development NiMA Asghari, were able to dive into the nature of crypto regulation in China, how Matthew looks at the Web3 space, the future of NFT’s and Sino’s investment in Mintbase, as well as NEAR protocol and the future development of crypto in general.

What Is The State Of Crypto In China?

China is the single most important geographic region for the development of crypto. This fact however, is still not fully appreciated by most western crypto enthusiasts:

“Mainland China has some understanding of international crypto, international crypto has almost zero understanding of mainland China.”

From this perspective, Matthew views working in crypto in China as an opportunity to support international projects looking to break into the market. As Matthew goes onto explain there are huge cities in China with millions of people that few in the west have ever even heard about. And it is these developer and investor communities that hold serious promise in growing crypto ecosystems in the years to come.

As Matthew puts it:

“China is the business opportunity of the century. Same as blockchain. Super simple.”

What is the Regulatory Regime of Crypto in China Like?

China in general operates with much more legal grey area than other places like the United States or the European Union. Much of crypto falls into that category. However, in general Matthew explained that the Chinese Government has three primary rails when it comes to handling crypto:

First (1), the Chinese are extremely sensitive to any kind of fiat on or offramp. This is because the Chinese Renminbi is not a free floating currency and there are very strict currency controls. As Matthew says, “That is why we do not do fiat anything on or offramp – Go nowhere near that.”

Second (2), authorities in China have a huge sensitivity towards anything that might be related to tax evasion or money laundering.

Third (3), there is a special sensitivity to speculative fervor in China. The fact that scams can snowball and expand exponentially make them hard to control if they mature to a certain point. So authorities in China are very cautious of ensuring that a project is not a scam.

Matthew says the following about the rest:

“With the exception of these 3 rails much of crypto falls into this grey area. So there will be periodic crackdowns and then they will ease up. This grey area becomes a matter of relationships and things like that. What people tend to do is just keep a low profile because they just don’t want to attract attention to themselves.”

Crypto is Still Not Very Well Understood, By Most People

Sino Global Capital works at the intersection of finance and technology, in both the East and the West. As broad as that might sound, they have a very strong focus on the world of crypto, specifically as it pertains to Decentralized Finance and Non-Fungible Tokens. From this position, Matthew was insightful in his analysis of crypto and its current level of understanding among the population based upon its level of development:

“This is still an industry that is very, very early in its life cycle. I still think we are late 90s, maybe like 1996 from the perspective of the United States and the Internet Industry this is still like 1996. We don’t even have Google Yet…The point is that we are super, super early. And this can cause a lot of misconceptions because when you have an industry that is still fairly early, you still have a lot of cowboy type people that are kind of sketchy and all kinds of people that are still involved.”

One crucial difference, in spite of the youth of crypto, is how it is viewed on a political level by different governments from the East to the West.

“The promotion of enterprise blockchain and blockchain related innovation is happening in China now probably on a grander scale. We will likely see what we have seen with other technologies anointed by the central government — which is tremendous over investment — like they did with solar — a lot of games to get government subsidies, but ultimately we will get a lot of interesting successes that come out of this. That is the most likely scenario in that regard.”

This comes in stark contrast to the more individualistic and business-first approach from the West, where many companies experimented with blockchain, but did not realize immediate value, and thus did not continue to experiment with it.

NFT’s Are Also In Their Early Days

A key part of the conversation took place when Matthew spoke about NFT’s and Sino’s investment in Mintbase. This is what he said:

“Our thesis with NFTs is that we are very early. And that it is taught to prognosticate which aspects of NFTs are likely to take off first or most. It is easy to see how NFT use cases could be super cool for many different applications – like Digital Art… In game NFT’s are something that have a lot of potential as well.”

In terms of Mintbase, Matthew went into detail about why he was confident in Sino’s investment in the Mintbase Team:

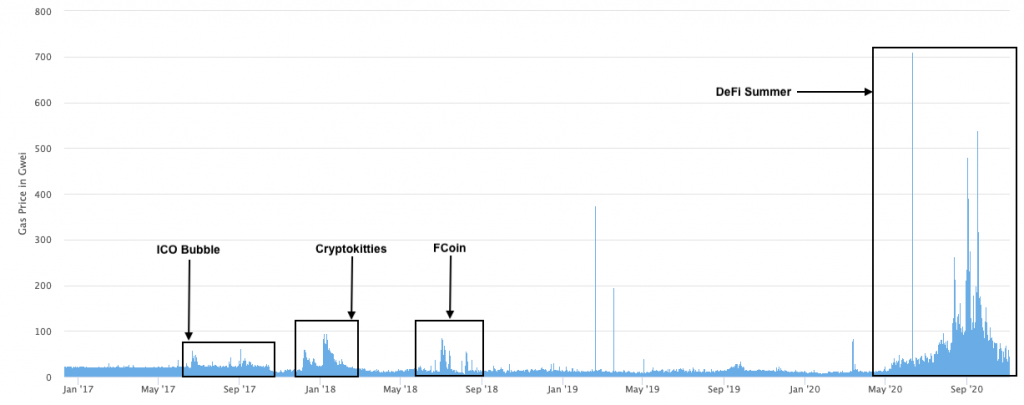

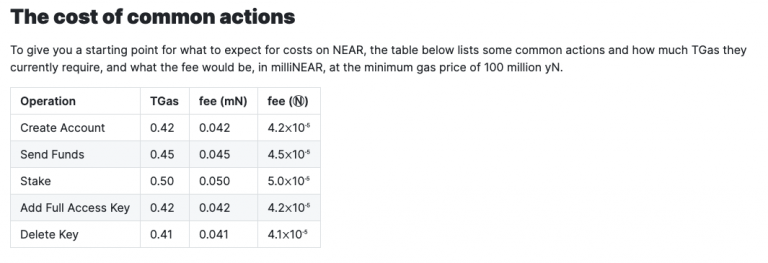

“One reason that we are super comfortable on them is that they were approaching it — not as NFT’s for gaming or a specific vertical – but more from the perspective of being ready to pivot – the industry could go in different directions. How we are going to get prepared to go with the trend in multiple ways. They are approaching this as seasoned technology and business experts in different directions…But at the same time they also have long term vision, saying look NFT’s on Ethereum – we think Gas fees will continue to be an issue. We were already one of the top Ethereum Dapps on the dApp store. For NFT’s to take off and for gaming NFT’s to really happen in a realistic way you have to have reasonable fees associated with doing these types of transactions.”

Overall Matthew held that Sino viewed NFT’s today, analogously to where DeFi was in 2018. As such the time for NFT’s is very much yet to come.

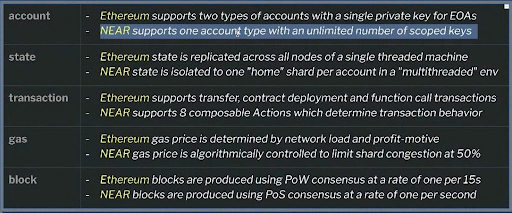

NEAR is a Serious L1 Blockchain Protocol

While Sino does not hold a position in NEAR, it does remain in their highest esteem. Matthew answered a couple of questions relating to NEAR and what he thought was especially valuable about the NEAR Ecosystem:

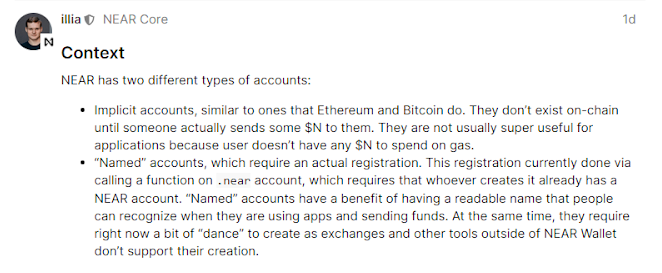

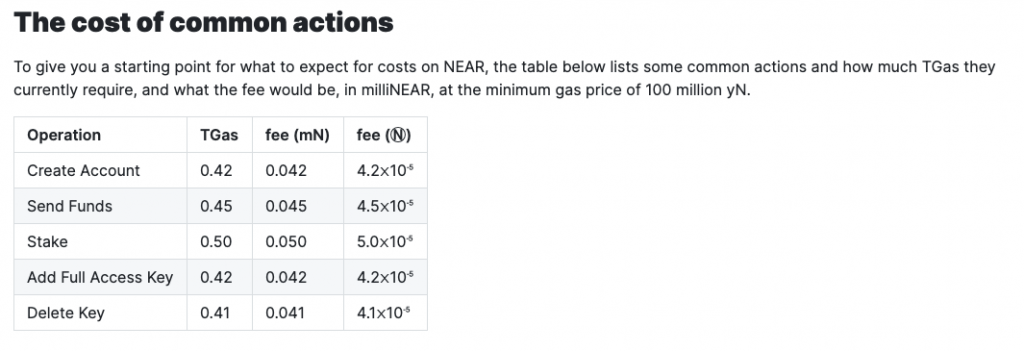

“A lot of it is that the devil is in the details, but also you have a world class team that is able to execute and build developer relationships – that is number 1. Number 2 – the fact that you can have sharding but maintain composability is something that is super important. A third point is that there are a lot of things that are super sexy for developers such as the fact that you can program in Rust — Rust is a famously developer friendly language and if they were choosing a language to learn I think that very few people would want to choose Solidity over rust for example.”

Like Mintbase, Matthew reiterated that they also viewed NEAR as being in its very early days. And, yet in spite of that, it was positioned for ‘An extremely promising future’.

Other areas of discussion dealt with the history of computer innovation, the need for more UI / UX development in blockchain, and different ways to bridge the gap between crypto natives and normies. To see soundbites of this discussion check out the 4NTS Youtube Channel Here.

All images from Unsplash